Shortages of affordable housing are a long-standing challenge in the United States. High interest rates and low inventory are contributing to this issue, as is the growing number of millennials, who are looking for larger homes to raise families. For low-income Americans, the hunt for affordable housing can be especially tough.

Increasing the supply of housing is one way to address shortages and provide more affordable options. Today’s WatchBlog post looks at our recent work on efforts to expand affordable housing options.

Encouraging affordable housing

The Department of Housing and Urban Development (HUD) leads housing efforts at the national level. This includes everything from mortgage programs to construction. HUD has multiple programs that aim to increase the supply of affordable housing. One of these is the Self-Help Homeownership Opportunity Program (SHOP).

The SHOP program provides grants to nonprofits to help develop affordable housing units for low-income buyers. In our July and September 2023 reports, we found that SHOP grants helped build homes in more than 40 states and 140 metropolitan areas between fiscal years 2011 and 2020.

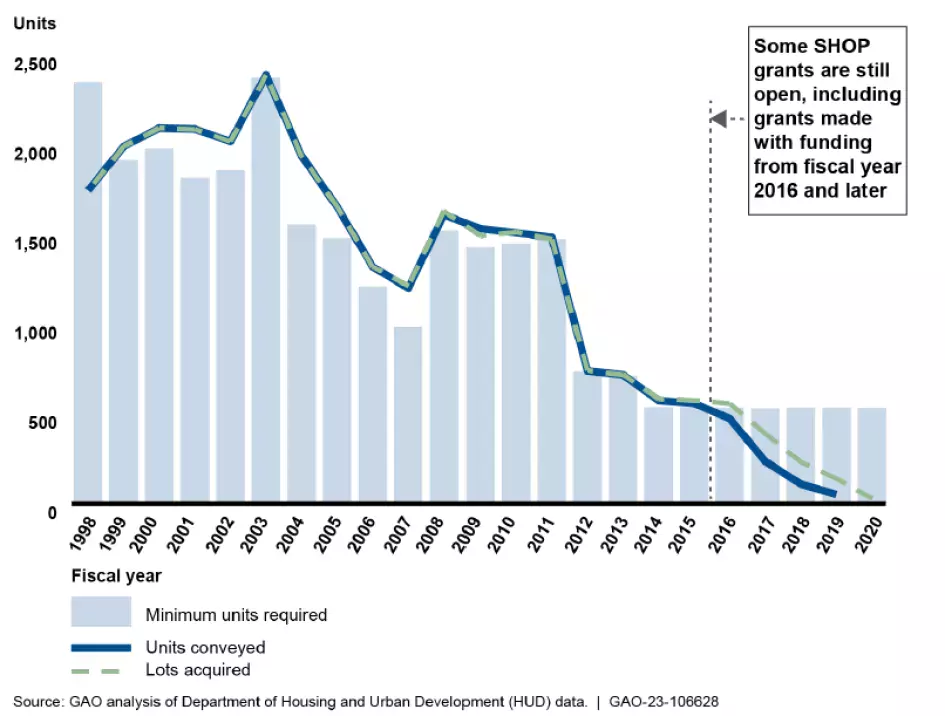

However, rising land and construction costs have put pressure on the program. For example, land prices increased 60% from 2012-2019, and the cost of homes more than doubled from 1998 to 2021. But HUD doesn’t adjust spending limits for grant recipients’ activities to keep pace with these increased costs. We found that the number of units required to be built with grant funding had declined dramatically overtime.

To help HUD make needed adjustments, we recommended that it use relevant data to determine when and how much to adjust spending limits.

Changes in SHOP’s Affordable Housing Development, FY1998–2020

Manufactured homes—homes that are built in factories—can be an affordable option for some, including lower-income homebuyers. Homebuyers can pay for these homes by taking out a mortgage loan, just like for other home purchases. But sometimes traditional loans are difficult to obtain when purchasing manufactured homes. This could mean that some borrowers use other kinds of financing, such as personal property loans, which can have less favorable rates and terms. Our September report found that HUD and several other federal agencies have taken steps to make manufactured housing loans more affordable. But HUD has not fully implemented proposed changes that would improve homebuyer access to loans for manufactured homes.

We recommended HUD implement planned changes, including establishing time frames and milestones for its actions, to provide additional financing options for manufactured homes.

What about renters?

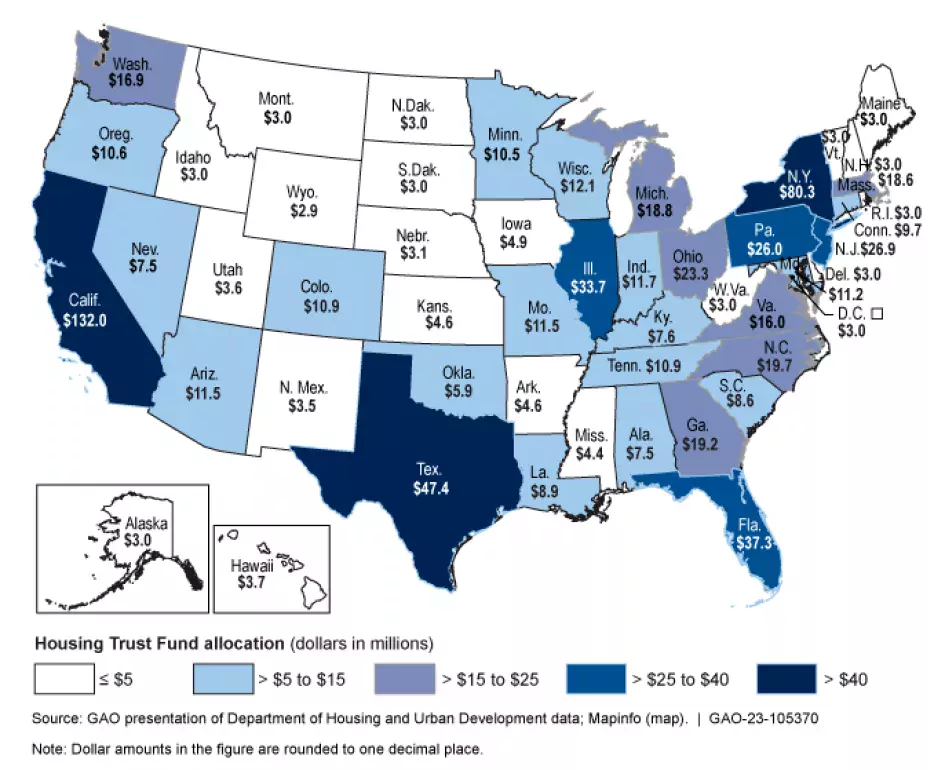

Many low-income renters also face shortages in affordable housing. During the last three years, rents increased about 24%. HUD’s Housing Trust Fund is designed to preserve and increase the number of affordable rental units available to extremely low-income households. Under this program, HUD provides funding to states for affordable housing rental projects. States have received varying amounts of funding for these projects each year since 2015. And, as of March 2022, the Fund’s grantees had developed almost 2,200 rental units in 263 projects.

Like other housing development and federal grant programs, the Fund faces fraud risks that are important for HUD to monitor. For example, grant recipients must submit audits of the project costs to determine that the funds are used properly. However, we found that the majority of selected grantees did not comply with HUD’s requirements for these audits. In our August report, we found ways to improve HUD’s oversight of the Fund, such as implementing a process to monitor grantee compliance with project reporting requirements.

Housing Trust Fund Allocations for 2022, by State

As demand for affordable housing continues to grow, so will the need for affordable options. Learn more about our work on federal efforts to address affordable housing by checking our key issue page.